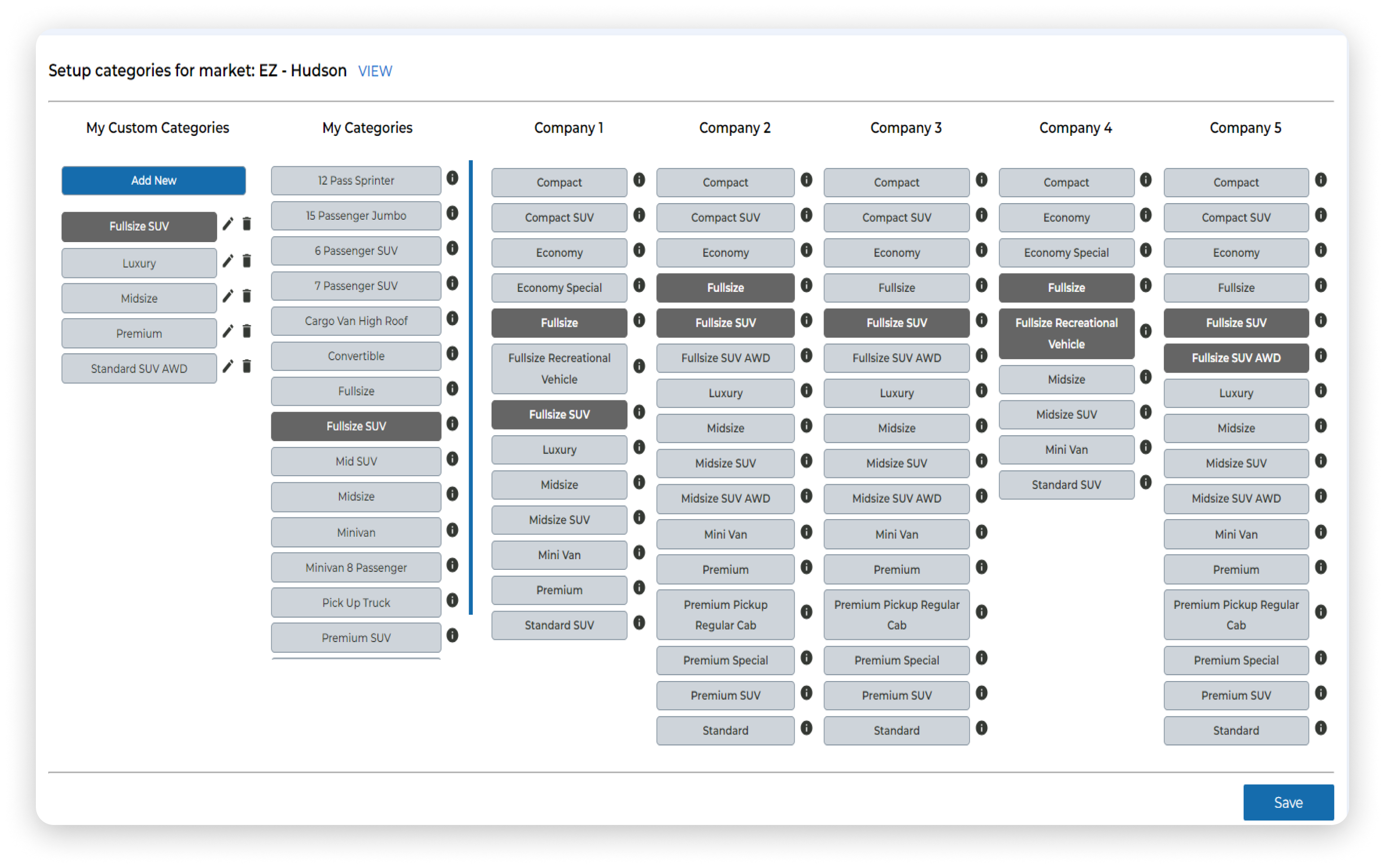

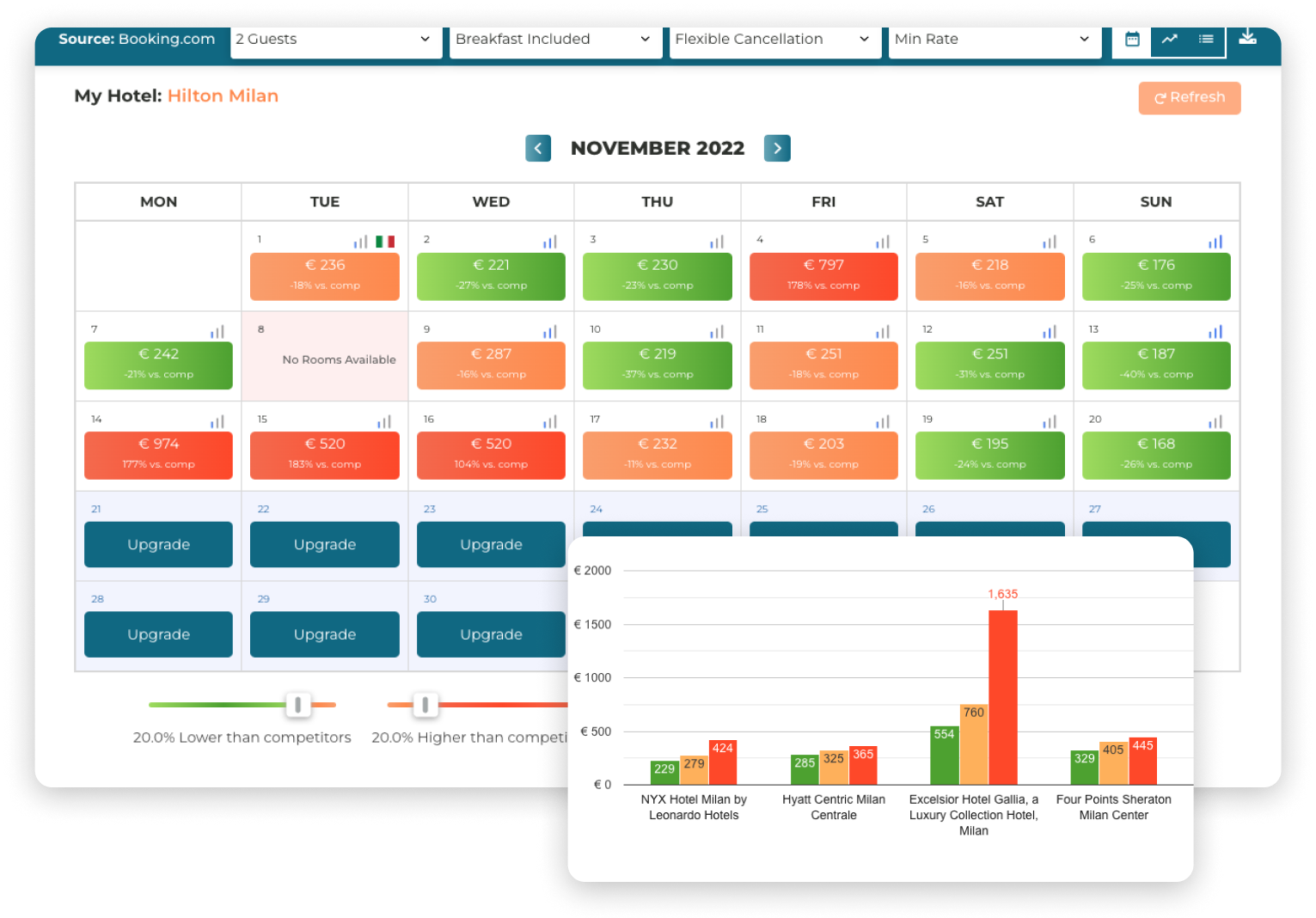

Create your own category maps to monitor like-for-like the way you want

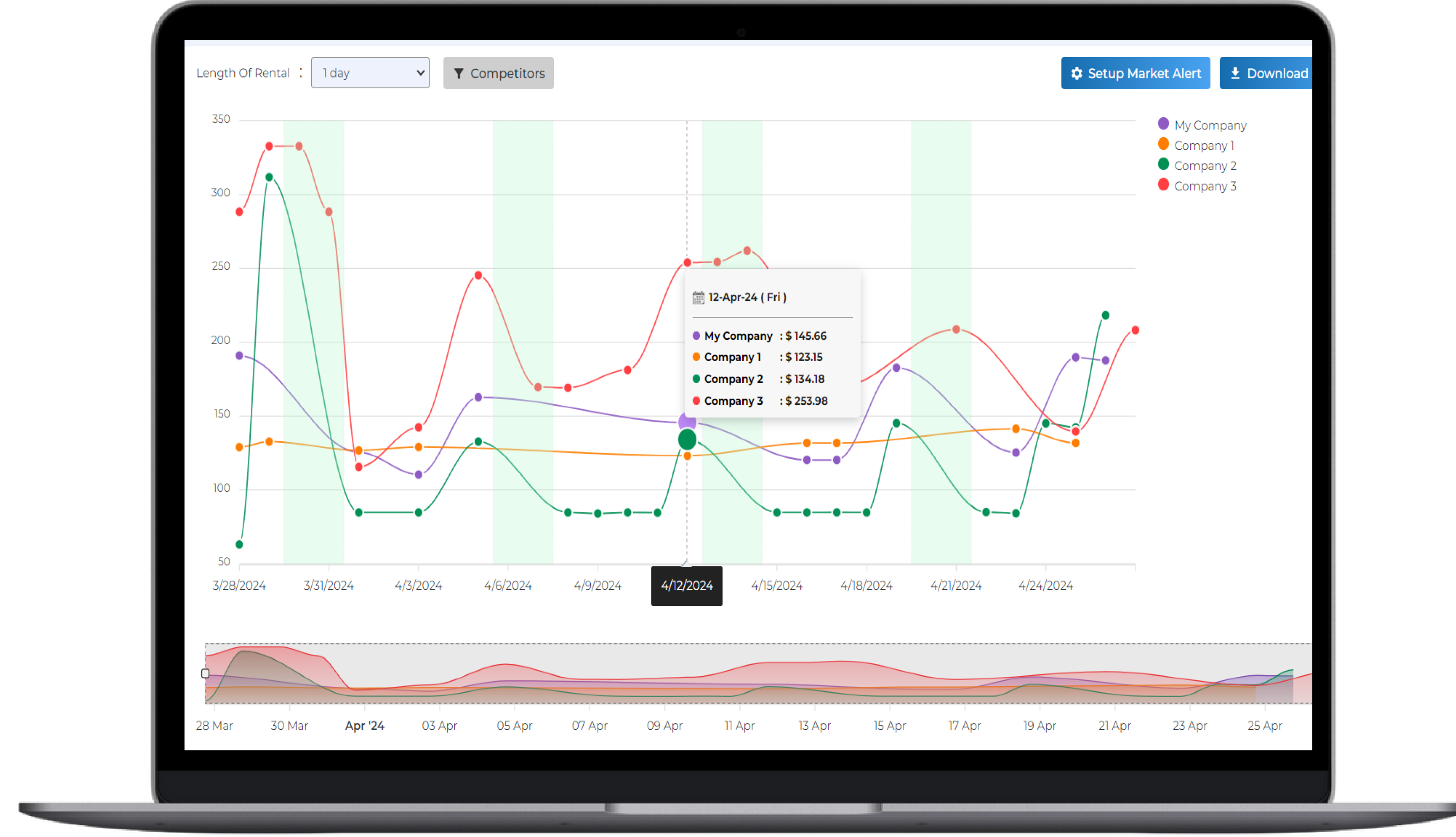

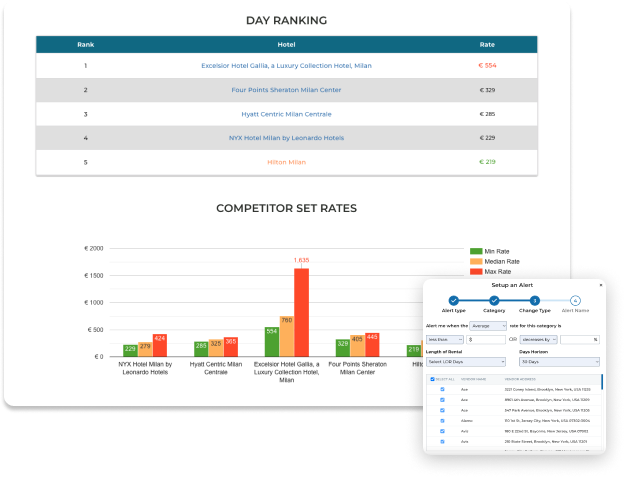

Include/exclude competitors and offers to focus on meaningful activity that affects your business

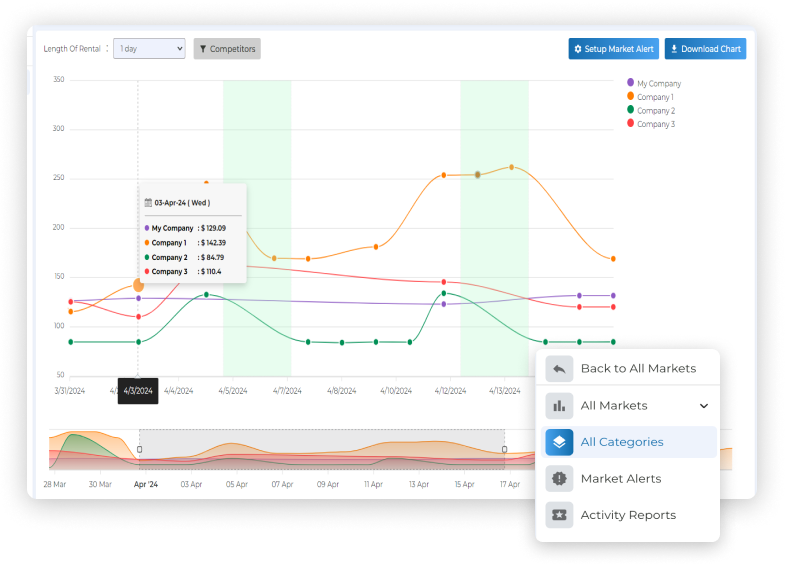

See historical rate trends, evolution, pricing behavior and volatility and understand market dynamics

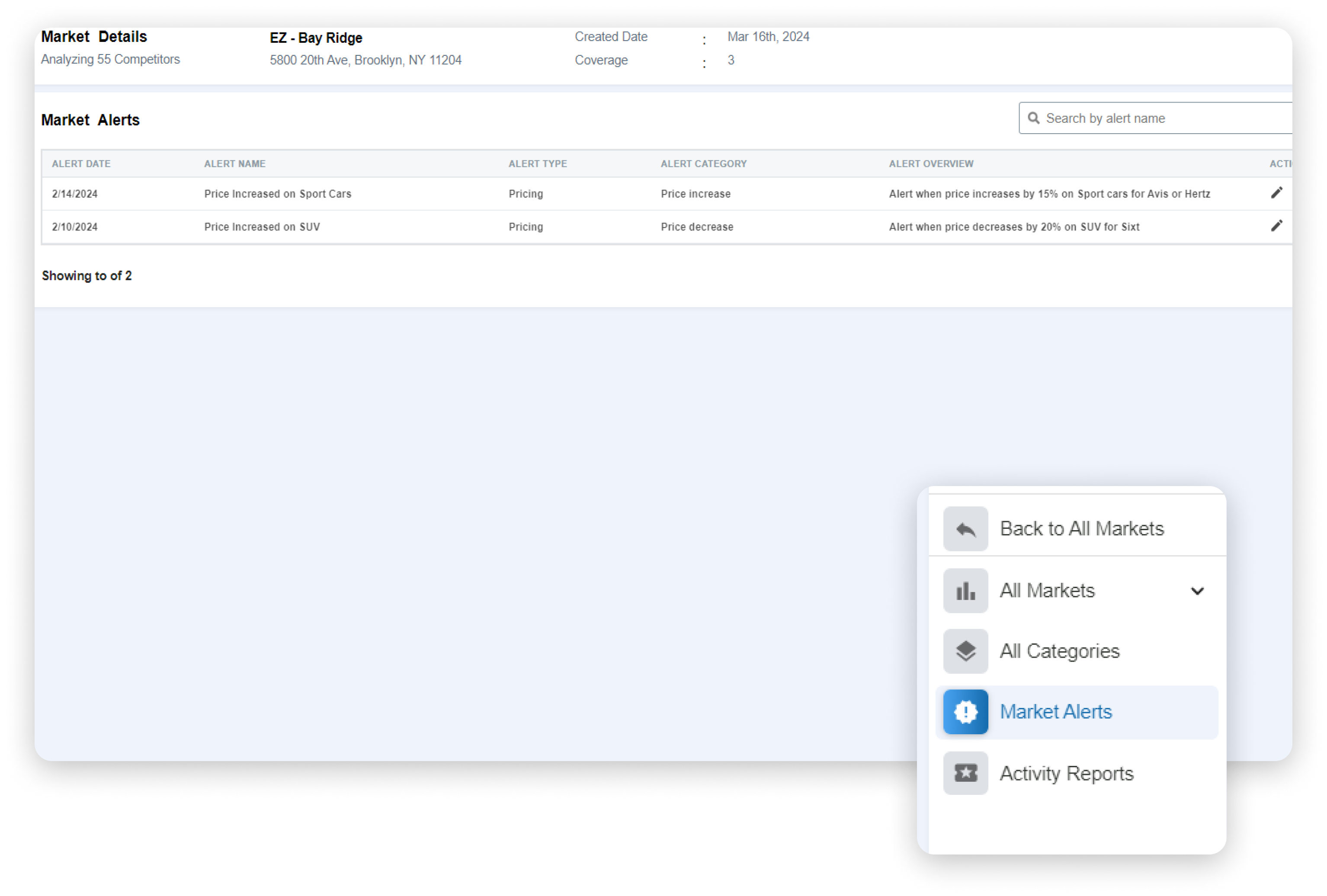

Include/exclude competitors and offers to focus on meaningful activity that affects your business